BY MARILYN WILSON, THE OTTAWA CITIZEN August 21, 2014

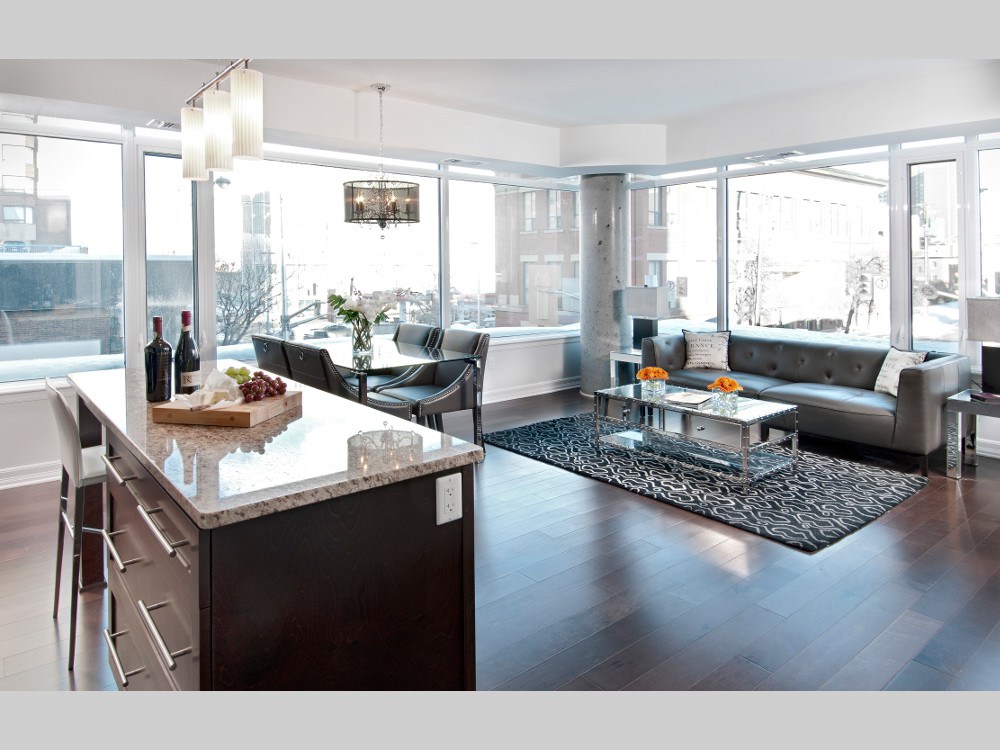

Richcraft’s Galleria 2 building is seeing interest from the parents of nearby University of Ottawa students, especially its two-bedroom units.

Those who live within an easy commute of school have the most options.

The first, and most obvious, option is living at home. It’s comfortable, the least expensive choice, and offers the possibility of some ongoing parental supervision. But living at home can mean your child fails to learn important life lessons such as financial management and cooking and cleaning skills.

The second choice — dormitory life — is the most popular one for first-year students. It’s a way of taking a step toward independent living without having to jump in with both feet.

But by second year, these students are often ready to move on to their first grown-up apartments. And that has led to a new trend in condos: parents who purchase units as an investment and have their children as tenants.

There are many advantages to this strategy. First, you have an investment property that may accumulate in value.

Second, you are more likely to be able to provide your child with a secure building in a safe neighbourhood if you are shopping for a place to live on your budget, rather than a student budget. Have you heard the saying, “champagne taste on a beer budget”? Essentially, your child is living this motto, and you can rest easy knowing that they are living in a safe place.

It may also be a beneficial arrangement for you. If you were already looking to purchase an out-of-town investment property, there’s a better chance it will be taken care of when you’re not there. And when you are in town, you’ll save on hotel bills by bunking with your child.

Ottawa is fortunate to have many condominium offerings near Algonquin College, Carleton University and the University of Ottawa, but this trend of having parents buy a unit for their child’s university years is most popular in other cities, like Montreal, Toronto and New York.

The number of Ottawa parents pursuing this strategy seems relatively small, according to an informal poll of new condo development sales staff, but out-of-province buyers purchasing for their children here make up about seven to 10 per cent of the condo sales in newer developments.

The biggest reason parents will buy is for the long-term investment. They tend to keep finishes basic and upgrades to a minimum, unless they’re purchasing a condo they will later occupy full time. The idea is to have a clean, safe environment for the student to study and get good grades.

In general, parents do not see the move as a simple investment strategy, but rather as something that will meet their children’s needs and then be sold or later rented out, possibly to other parents in the same situation.

The attractiveness increases for parents with several children who are likely to need housing one after the other, which gives the investment more time to mature.

Although at first glance buying a new condo for this purpose may seem expensive, when the financial and other pros and cons are laid out it may make sense for your situation. With all the condo buildings coming up around the city, you are sure to find one that appeals to you, as an investor or as a parent.

If your child does not drive, for instance, avoid a building in an area with limited pedestrian activity. If, however, your child does drive, ensure the building offers parking, either included in the purchase or as an added feature.

As a first step, create a pros and cons list to ensure you’re meeting both your needs and those of your student.

Marilyn Wilson has been selling real estate for more than 24 years and owns Marilyn Wilson Dream Properties Inc. Brokerage, an Exclusive Affiliate of Christie’s International Real Estate. She can be reached through dreamproperties.com.